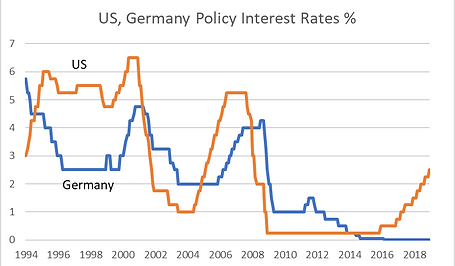

Europe's cycle follows the US, (usually)

Europe tends to follow the US business cycle with a few months lag. This has long been the pattern for Germany versus the US and, since 1999, has become the pattern for the euro area as a whole too. The lag is most clearly seen in the behaviour of unemployment. I have marked the turning points in 2001, 2003 and 2007 where US unemployment changed direction but German unemployment followed with a lag of 10, 17 and 10 months respectively.

Of course, the euro crisis in 2011-12 was a major exception to the usual pattern. After a brief pick-up in 2009-10 the euro area suffered a double-dip recession as fears for Greece, Italy, Portugal and Ireland grew. The euro crisis was a home-grown disaster caused by the fixed currency euro area and so was a special case. A repeat can’t be ruled out if Italy pushes too hard or threatens to leave the euro area. But the point is that the US did not follow the euro area into recession in 2011. Europe is still a follower except when it trips up on its own.

The Coronavirus has caused a slump as elsewhere, with European countries particularly badly hit. The euro zone still has weak banks, particularly in Italy and Germany and yet there will be a new wave of bad debt. Further, although the ECB is actively buying huge quantities of government debt helping to keep Italian bond yields down for now, the crisis has revealed the continuing reluctance of northern states, particularly Germany and Holland, to support the south.

Last updated 31st March 2020